The Fed Saved Me from the Bank Collapse: But is it a Lifeline or a Trap?

I never thought I would see the day when my bank would fail.

On Mar 11th I lost access to my Silicon Valley bank account. And within within 24hrs, it was shutdown and taken over by the FDIC.

But this isn’t an isolated incident.

There were at least Five bank failures occurring in less than a month.

- - Silvergate

- - Silicon Valley Bank (bought by First Citizens Bank for $0.5 Million)

- - Signature Bank (Shut down for doing business w/ crypto?!?)

- - First Republic

- - Credit Suisse (bailed out by the Swiss)

Deutsche Bank & Charles Schwab are reportedly facing difficulties as well.

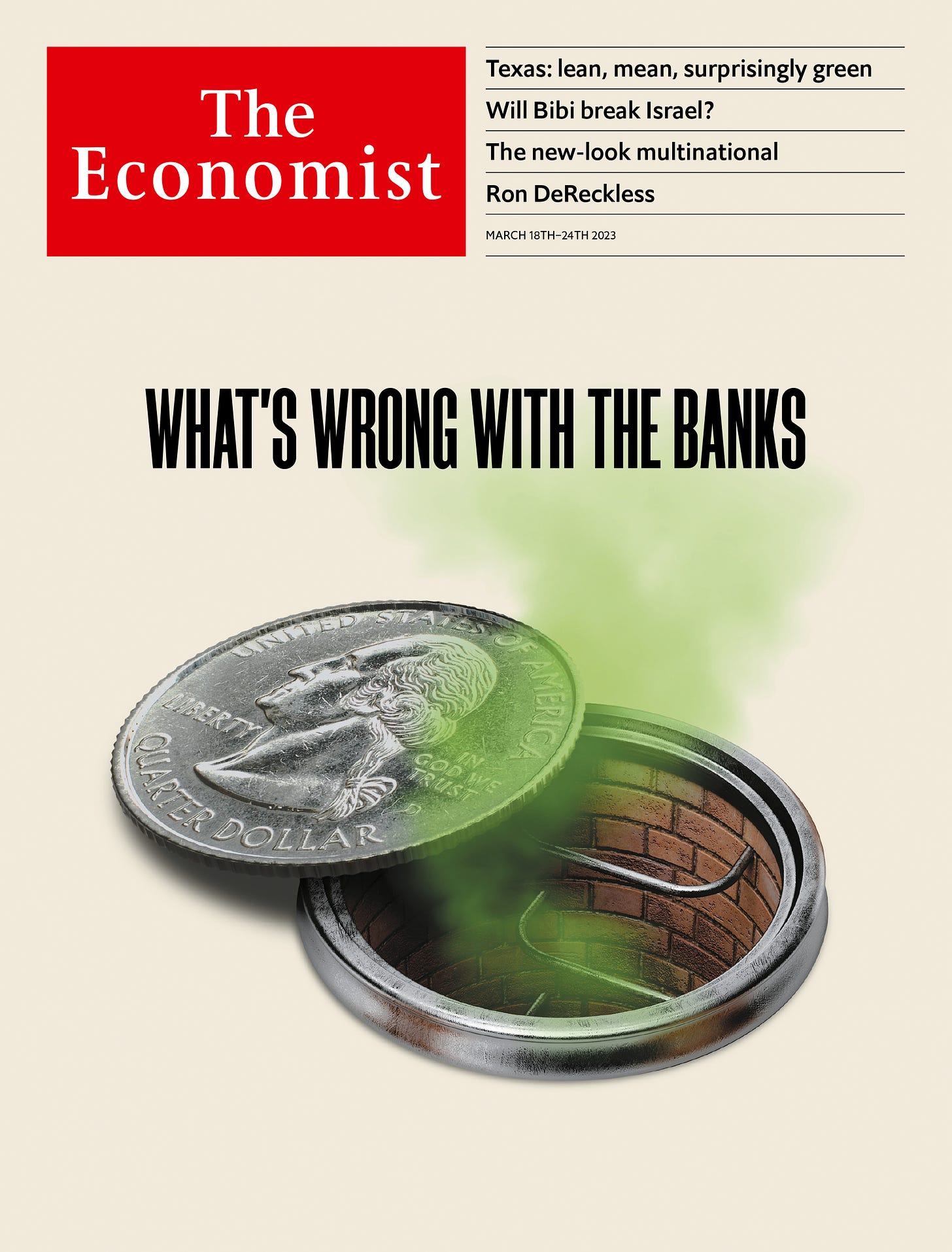

The Economist reported that banks have hundreds of billions in deposits missing.

Where did it All go?

|

|

For the TL;DR people, what’s happening is this:

Bank takes deposits from customers, both individuals and businesses → Bank then invests most of those deposits in loans or low-risk securities (i.e. Treasuries), keeping some cash on reserve for when a depositor wants their money back

In other words, when you deposit your money in the bank, it is no longer yours. It is a loan to the bank, an IOU that they put on their books. They owe you that money back. But they’ve lent much of it out. Most banks have just 10-15% of the assets (not cash—this is an important distinction, and we will come back to it) that they have borrowed sitting in their own accounts, and a measly amount of actual cash sitting in their vaults.

This is the beauty and wonder of Fractional Reserves.

Sure, there’s all kinds of fancy terminology and images of vaults and frontier wagons and all, but in reality, you are trusting the bank to pay you back.

You are trusting the system.

Bottom line, if all the customers want their deposits (their ‘money’) back, if they want to withdraw it from their checking or savings accounts, the bank cannot possibly meet all those obligations at once.

They certainly cannot give you actual cold hard cash from their so-called vault.

This is called a run on the bank and it’s how most bank failures happen.

It is also why they’re gradually phasing out cold hard cash from circulating within the economy.

|

KEEPING TRACK ON WHAT HAPPENED:

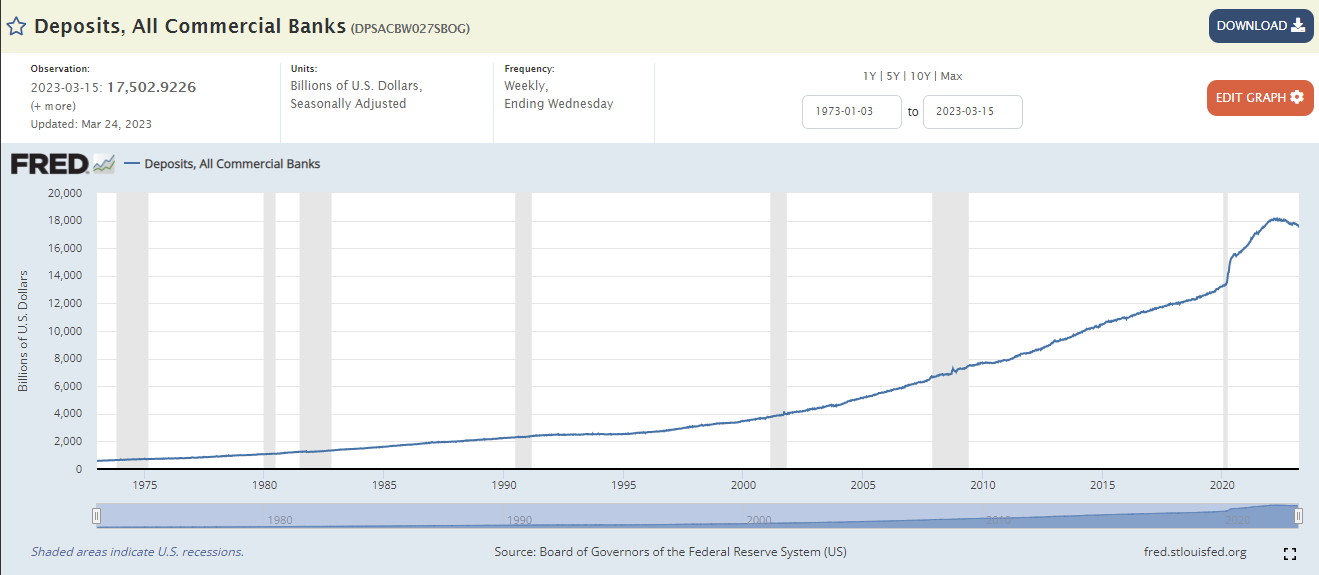

+ FDIC deposit insurance fund: $128.2 billion

- Signature cost: ~$2.5 billion

- SVB cost: ~$20 billion

------------------------

= FDIC balance: $105.7 billion

vs.

* Total insured deposits: $10.1 trillion

* Total US commercial bank deposits: $17.5 trillion

So this would mean the FDIC only covers approx. 1.05% out of $10.1 trillion.

|

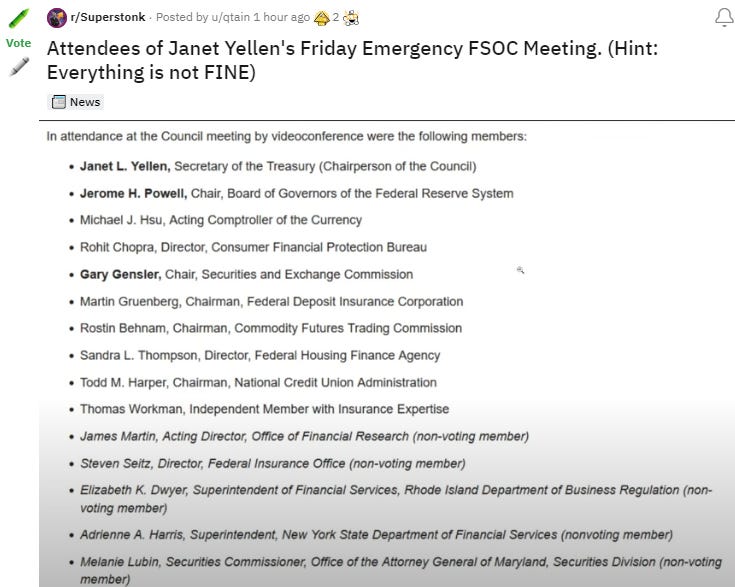

It wasn’t long before someone caught on to this frightening fact.

That is why there was a meeting of all these ‘‘important’’ people. You would need to get these people together only if something is going terribly wrong.

|

Get this; these are things ‘‘according to them’’ that you don’t need to know.

They will say; don’t worry - the banks are safe, your money is safe. There’s is nothing to worry about.

When you hear all of that, it's when it's time to run like hell.

March 12th 2023

|

If you’re old enough to remember…

On Sunday afternoon, September 14, 2008, hundreds of employees of the financial giant Lehman Brothers walked into the bank’s headquarters at 745 Seventh Avenue in New York City to clear out their offices and desks.

Lehman was hours away from declaring bankruptcy. And its collapse the next day triggered the worst economic and financial devastation since the Great Depression.

The S&P 500 fell by roughly 50%. Unemployment soared. And more than 100 other banks failed over the subsequent 12 months. It was a total disaster.

This bank, it turned out, had been using their depositors’ money to buy up special mortgage bonds. But these bonds were so risky that they eventually became known as “toxic securities” or “toxic assets”.

These toxic assets were bundles of risky, no-money-down mortgages given to sub-prime “NINJAs”, i.e. borrowers with No Income, No Job, no Assets who had a history of NOT paying their bills.

When the economy was doing well in 2006 and 2007, banks earned record profits from their toxic assets.

But when economic conditions started to worsen in 2008, those toxic assets plunged in value… and dozens of banks got wiped out.

What did the elected officials choose to do?

Four things:

- Exorbitant stimulus packages

- Bank bailouts - Massive Capital Injection

- Regulatory reform - Reduce withdrawal limits, etc… more red tape

- International cooperation

They simply decided to kick the can further down the road. And hope it didn’t happen again. 🤞

Let future generations pay for the people who made those silly financial blunders.

Privatized profits, socialized losses.

Well, the can is right in front of a 12ft wall this time.

And there’s no way to kick it over the wall unless you can trap people within this walled system. (What CBDCs like the system in China would do - FedNow which is due to launch in July)

It’s time to pay attention, because this time the monetary energy is at stake!

March 27th 2023

|

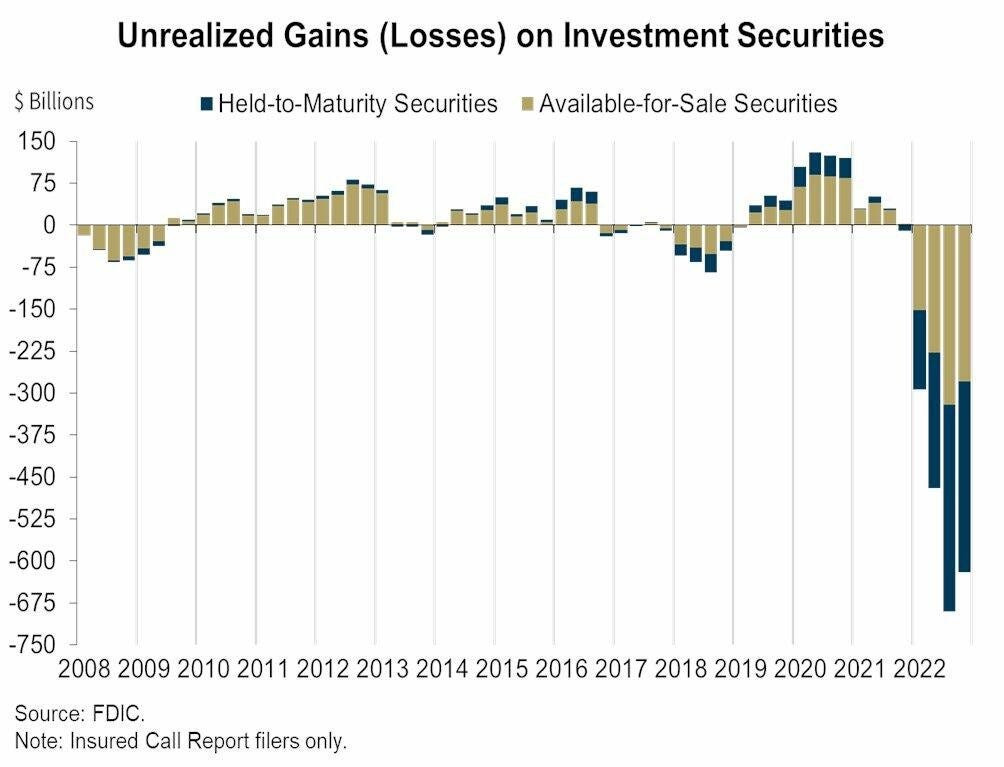

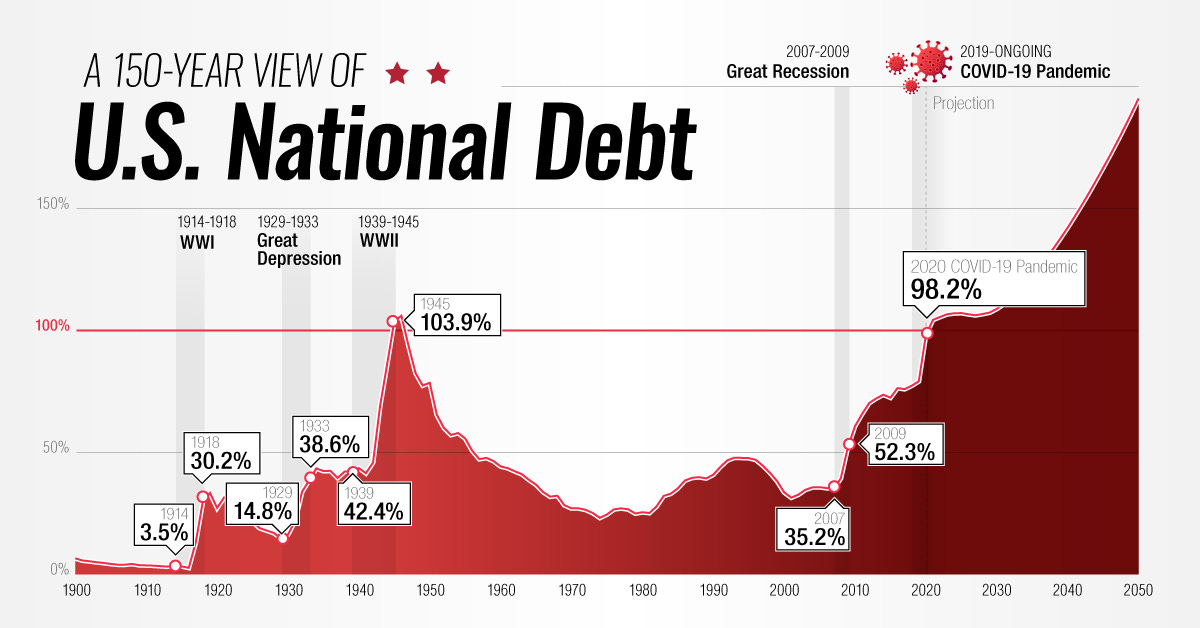

The FDIC itself reported that banks across the US have a total of $620 billion in unrealized losses; this is due primarily to the steep decline in bond prices, which are a result of the Federal Reserve’s aggressive interest rate increases.

And bear in mind that the FDIC’s estimate was before the most recent rate hikes. So the updated estimate on unrealized losses right now is most likely higher than $620 billion.

|

Where did the banks invest ALL of our savings?

They all used the deposits to buy the ultimate shitcoin: long-dated US Treasuries. And they all got rekt at the same time, in the same way, because they bought the same asset from the same vendor who devalued it at the same time: the Fed.

Specifically, as NYT admitted, banks "binged" on enormous amounts of Treasuries and other long-term bonds in 2021 when the flood of printed money cut off their typical demand for loans, and because they thought the Fed would keep interest rates low forever.

|

Enter; BTFP - Bank Term Funding Program.

Basically, it’s a fancy way of saying, we’re going to inject more ‘‘made-up’’ capital directly into the veins of these ‘‘addict’’ fiat junkies so that the banks can continue to service the public.

What this does is ensure that banks have the ability to meet ALL the needs of their depositors.

If banks don't have enough money to support client withdrawals, they can simply take a loan from the BTFP with bank assets as collateral.

|

It may sound great, but they’re stealing from you and me in perpetuity.

The government is in fact Stealing From Every Dollar holder on the planet, making countries want to ditch the dollar.

Banks can now buy EVEN MORE assets and prop those bank stock prices up. They can pay executives and employees even bigger bonuses and increase the price of goods for everyone.

For Physicists, this is the ultimate free lunch.

‘‘Money for nothing, chicks for free…’’

They can borrow money from depositors to buy assets. Then, they can use those assets to borrow even more money from the BTFP if depositors EVER want their money back.

Its a vicious feedback loop that ensures the destruction of fiat money complete.

|

|

|

This solution might be positive for the short term, but pain will be felt by the average person in the long term when inflation continues to rise and assets are unaffordable.

The average person won't be able to store wealth because currencies continue to lose value.

Over the next few years, the wealth gap will continue to get wider.

Anybody without assets won't be able to save for the future, reducing the chance of achieving financial freedom.

Most people are going to miss their chance to protect themselves because they don't understand how money works. Anyone without a plan is going to regret it in 10 years, when they're priced out of everything.

In essence, this isn’t a bailout… it’s a time bomb.

We can keep our fingers crossed and hope that this time bomb never explodes. But if it does, the Federal Reserve is going to be looking at hundreds of billions in losses… which would trigger devastating consequences for the US dollar.

March 12th 2023

|

This means that everyone who uses US dollars… including every man, woman, and child, is ultimately on the hook for the potential consequences of the BTFP.

We are already seeing new regulatory rules in a futile attempt to curb the inevitable demise.

|

Now the question is, do you want to be trapped inside the financial system of FedNow dollars and continue to lose >20% of your purchasing power every single year?

|

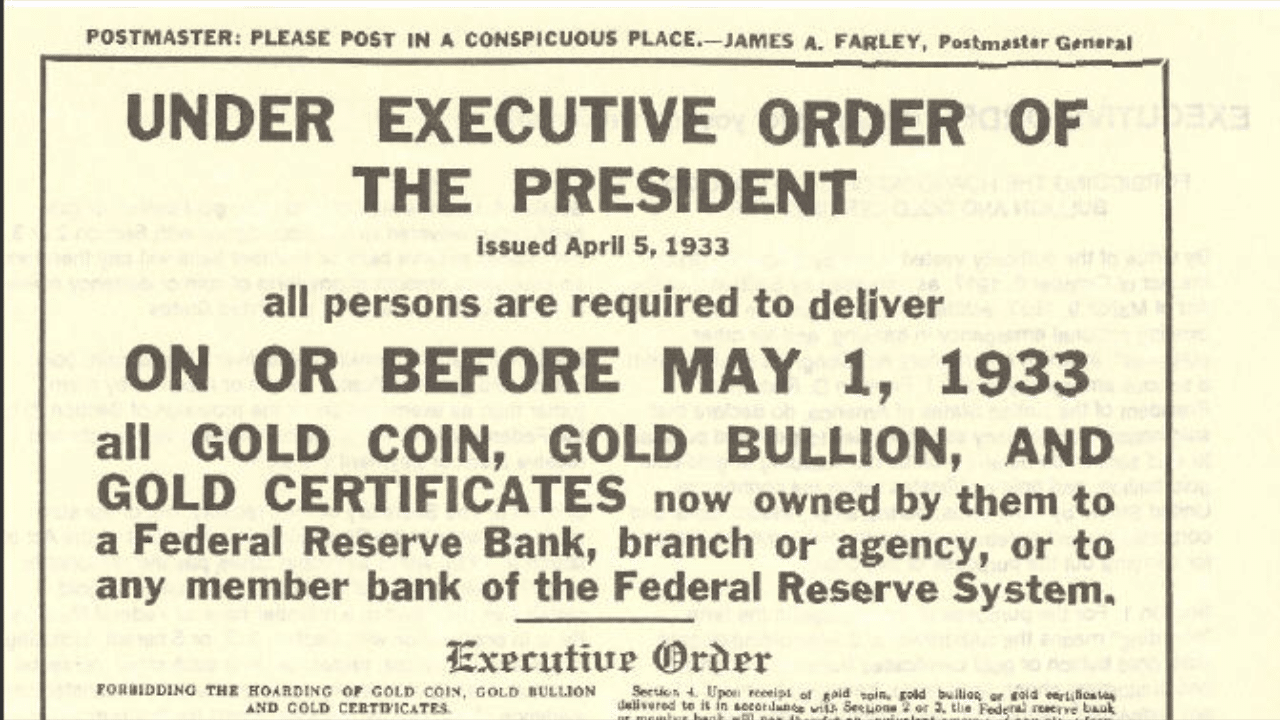

If the government becomes desperate enough, they will certainly attempt to lock you in and ban you from owning anything other than their FedNow dollars.

It has happened before (to Gold holders), and it may well happen again.

|

To avoid losing their power & control, Governments will justify every means necessary; including removing your freedom and rights.

So your purchasing power will be gone just like that.

Decades of hard work gone. Poof!

Unless you get into hard money now, before the bridges get severed.

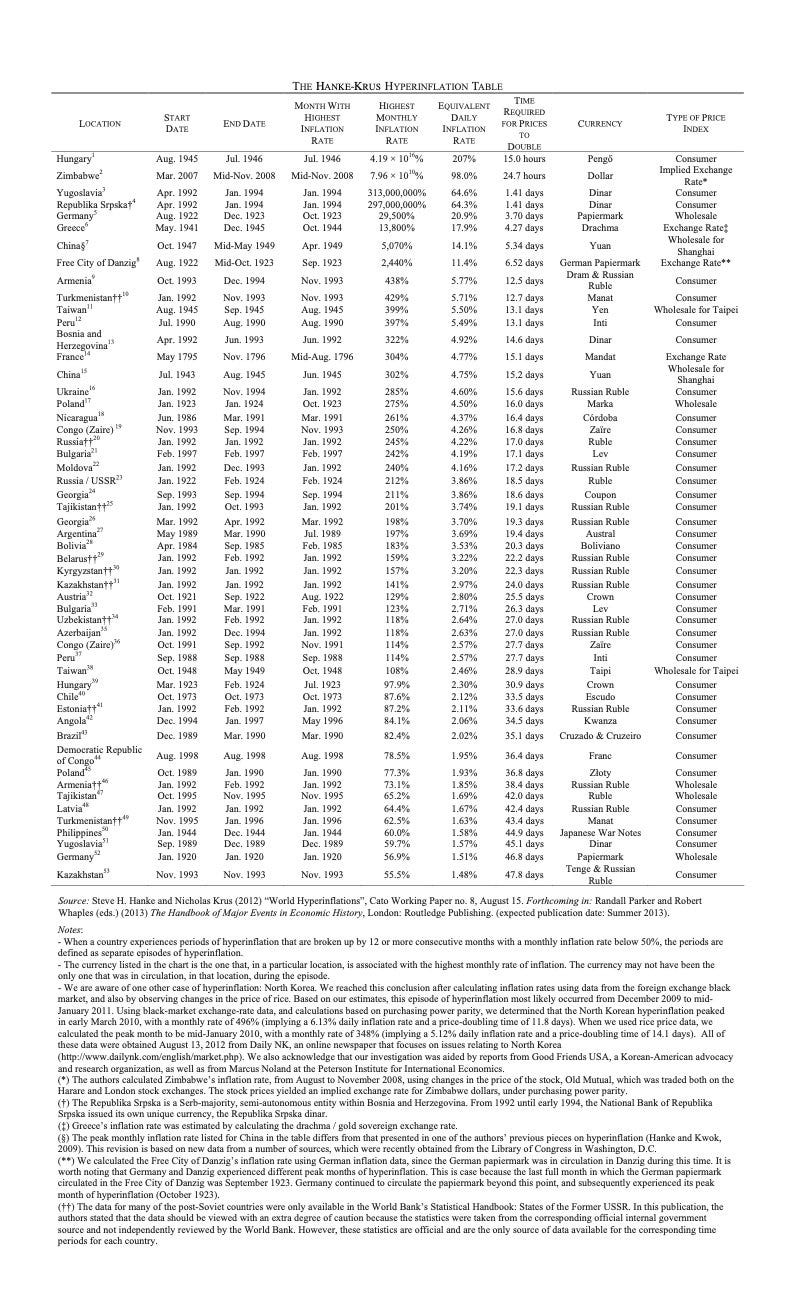

HYPERINFLATION IS COMMON AND VERY FAST

The speed of hyperinflation often catches people off guard.

Cato made a table of 56 episodes.

Prices in 1945 Hungary doubled in 15 hours!

How fast will this be in the internet age?

|

Sure you could buy as much gold as you can, but don’t forget what they did in the past. Unless you’re a pirate a few centuries ago, Gold is not easy for a modern man to secure.

How would you transact over the internet in fractions of it?

How do you secure something so gaudy in a city of a million people (without needing to trust a third party)?

This is what Bitcoin offers me in the digital age.

There is No better solution to this $100 Trillion dollar trilemma.

|

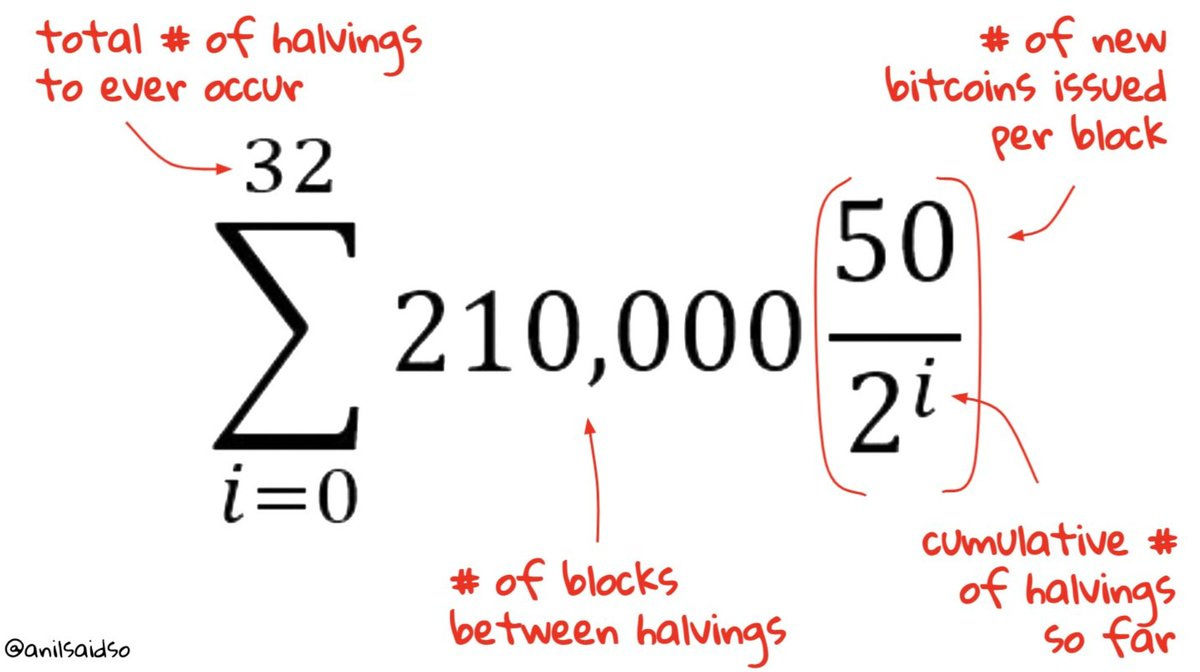

This Equation secures your purchasing power ad infinitum

So, while gold may have served as a store of value for centuries, it cannot match the convenience, divisibility and security of Bitcoin in today's digital age.

It was built (by Satoshi in 2009) to survive this dystopian present. But you must learn how to get your coins off exchanges!

|

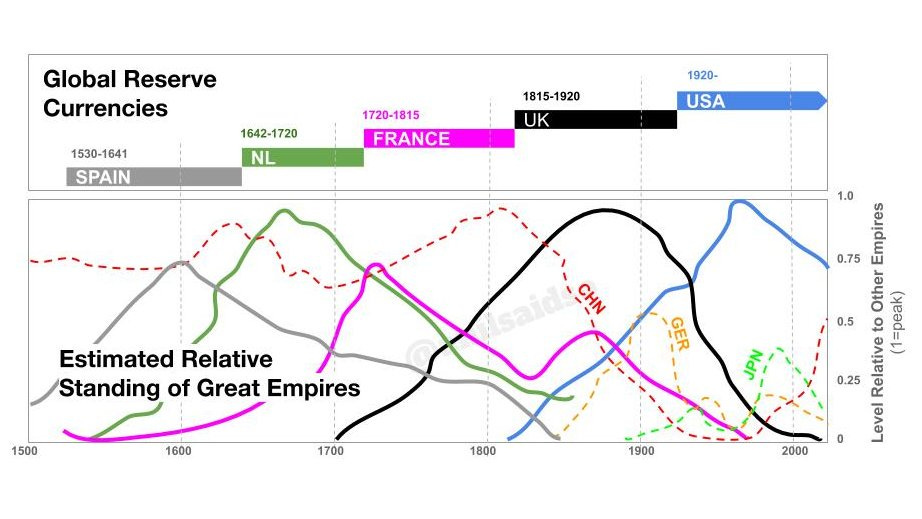

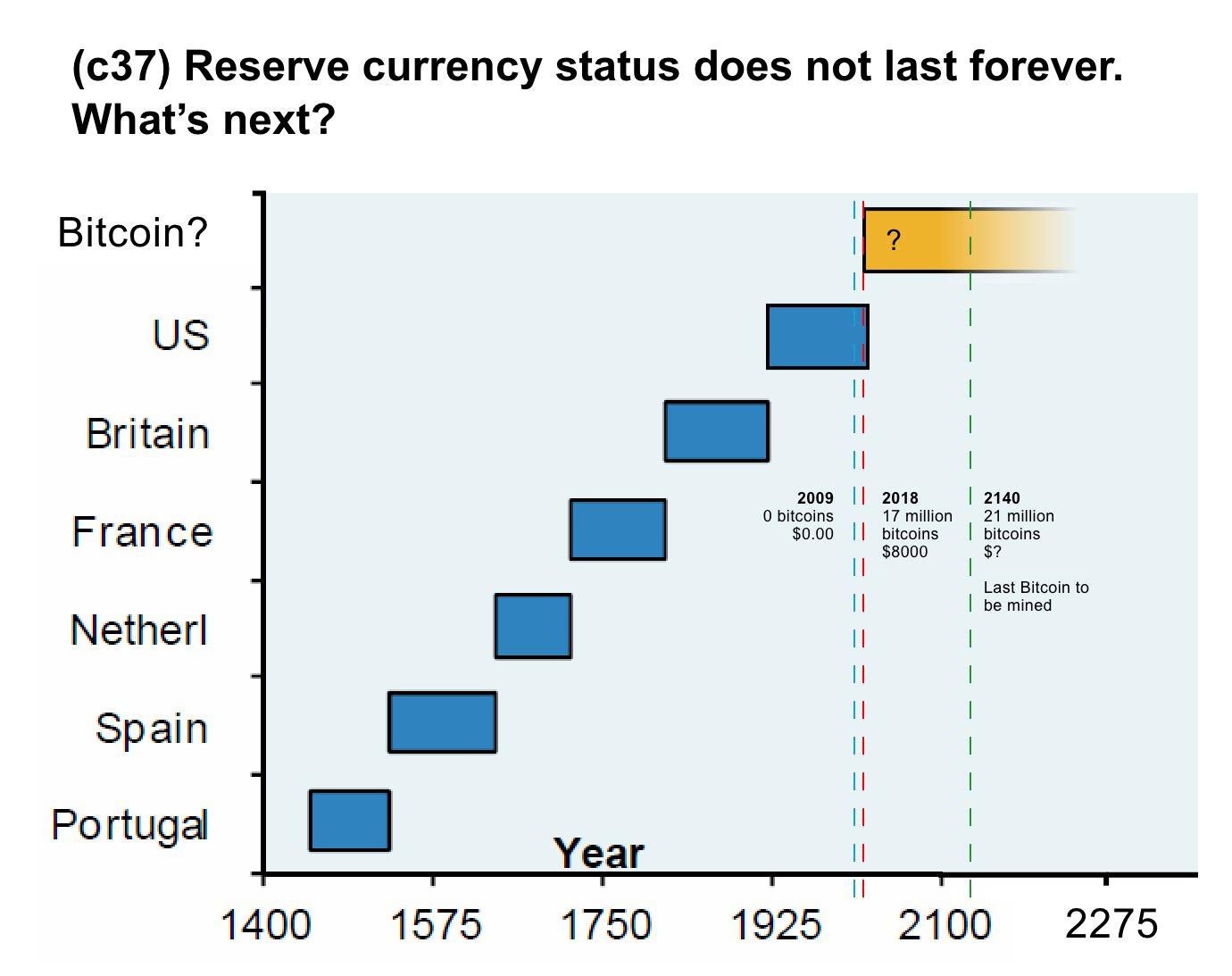

How devastating it is experience an accelerated demonetization of the U.S. Dollar only to have the Chinese Yuan next in line?

March 27th 2023

|

I don’t want my life force to be at the mercy of another nation’s whim and fancy.

For me, I believe it’s high time for the world to have its own borderless internet currency that’s neutral & fixed in monetary supply.

But "What good is Bitcoin if they ban it?"

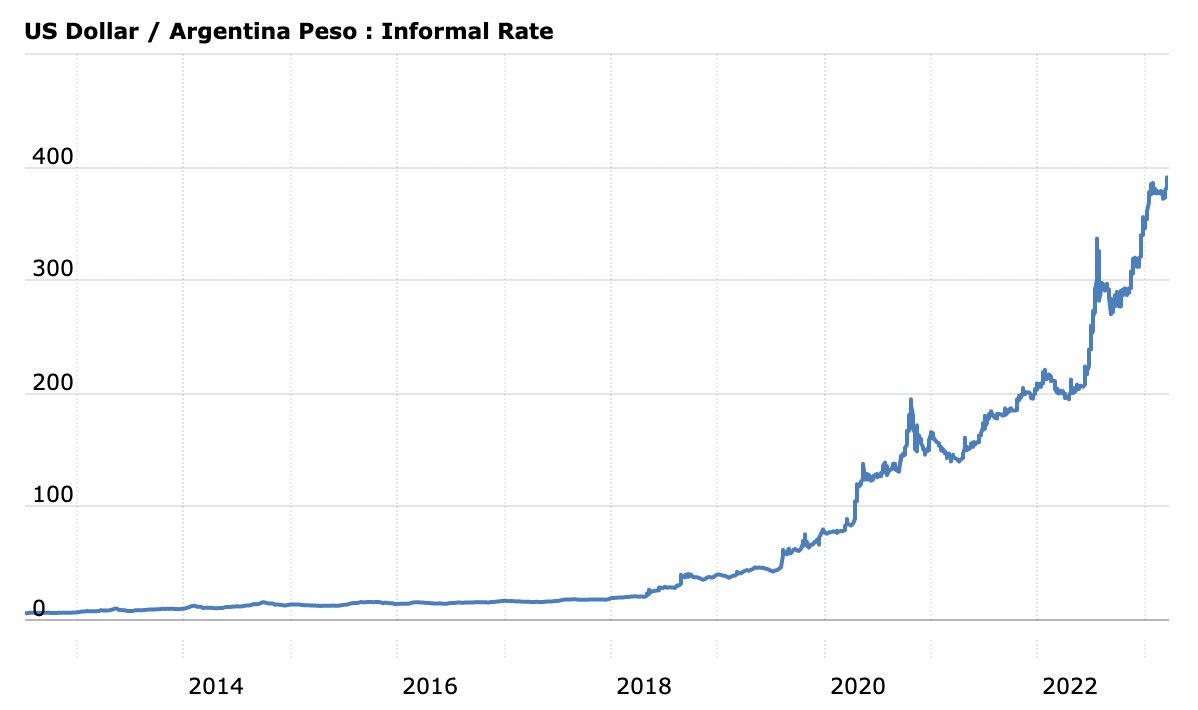

In 2012 Argentina banned citizens from buying Dollars to force them to save in Pesos. At the time you could get ~4 Pesos for one US Dollar.

Today you can get 389 Pesos for a Dollar.

|

On the contrary, banning the Dollar didn't make it disappear.

It made it more desirable.

People didn't forget about the Dollar's stronger purchasing power relative to the Peso.

So they started buying it on the black market rather than allowing their government to debase their savings.

If governments attempt to ban Bitcoin they can expect a similar outcome.

Make no mistake, they will try to block ALL the exits before this is over.

It will be a last ditch attempt to decelerate the decline of the U.S. Dollar and its hegemony.

Blocking the exits mean trapping you in the room with $31.6 Trillion worth of debt

|

So Get your monetary energy outside of the system BEFORE they debase/confiscate your entire life savings.

March 20th 2023

|

They will try to pin the blame of their demise on Bitcoin.

They will engineer a war and blame inflation on Foreigners.

They will say its the billionaires fault for not paying their fair share of taxes.

They will always blame everyone but themselves.

The global financial and energy system is Balkanising and it will lead to intense pockets of inflation.

Only a global currency operated and owned by and for humanity has infinite value.

This is when Bitcoin will show its true worth.

You have less than six months to do this…

March 12th 2023

|

Reminder: One does not buy insurance during the exodus.

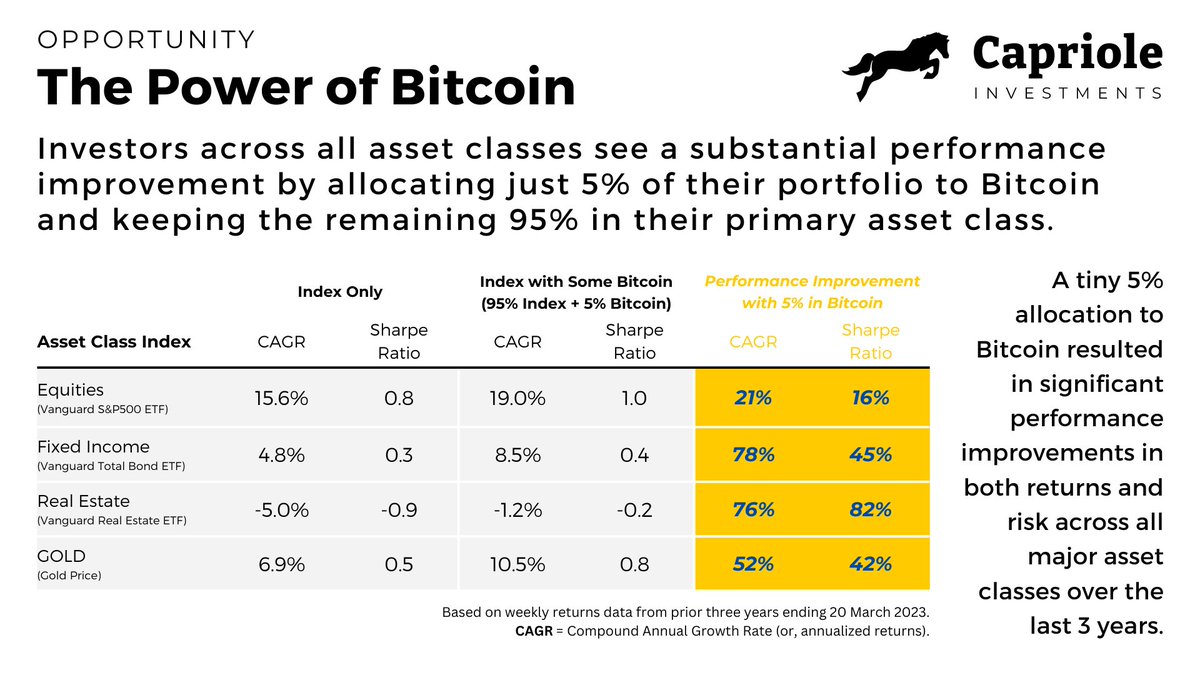

If you think buying and self-custodying bitcoin is silly, even putting a small % of your funds in bitcoin is a joke, now is the time to rethink that.

Imagine not having any cold stored Bitcoin at this time as an insurance policy , while watching tens of thousands of people scrambling to withdraw money from an ATM.

|

Think Maverick Pte. Ltd.

You can earn $10,000/m with just these tools. Turn your computer into an ATM machine. Here are 8 tools you need to start printing money on the internet: Marketers and content creators often wait for Black Friday deals before undertaking blog migrations or major upgrades to take advantage of the best discounts and bonuses. If you haven't seen it already, I scoured the web to find these amazing Black Friday deals. The first step is to buy an annual plan which includes hosting speed and power...

Hey bloggers, authors, webmasters and internet marketers! I'm excited to announce that I found some of the biggest sales of the year for my blog! For a limited time, you can save up to 85% on essential tools and resources that can help you and your blog grow globally. Here are just a few of the amazing deals you can find this year: Up to 85% off web hosting for WordPress Up to 99% off domain name Up to 62% off WordPress Plugins Up to 70% off Google Analytics And a Free MacBook Air Giveaway!...

Always Bear in Mind the Counterparty Risk! March 11, 2023 Yesterday, imagine the surprise when I saw Silicon Valley Bank (SVB) trending on Twitter. I have a corporate account with them. So I clicked on it to find out what’s going on. Rumors were circulating that SVB sold some securities at a huge loss. My face turned pale. I quickly logged into my account to try wire out my money. A few hours later, I checked and my account homepage was loading non-stop, not showing any balance details....